Well-managed finances are the key to a smooth, abundant, and debt-free life. Hence, this article lists and explains the best software for finance management and budgeting.

The last days of a month are often scary for many people. Wondering why? This is because it is when many users go through a dreaded period of cash crunch. Too many expenses on the head with little to no savings. Well, looking closely we realize this situation occurs because of poor money management. Hence, you can use the best personal finance software for accurate budgeting and managing your money.

These programs help you understand where all your money is going and how to manage your expenses for an improved financial standing. Hence, this article presents a carefully curated list of the best money management and budget software. Let us save valuable time by not beating around the bush and getting started with it right away.

Well-Researched List of the Best Personal Budgeting Software

Below are the software we like and recommend the most for personal finance management.

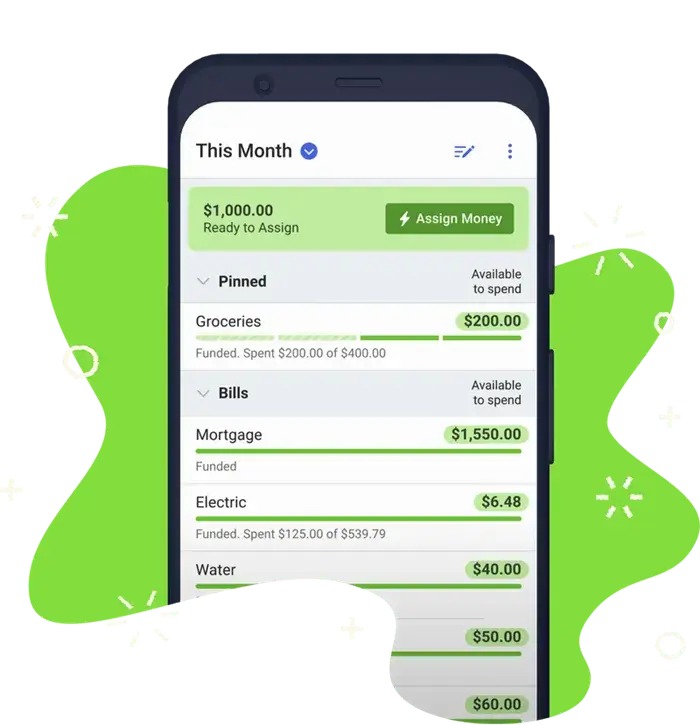

1. YNAB (You Need A Budget)

You truly need a budget to manage your finances smoothly. Hence, here is YNAB in our post dedicated to the best personal finance software. This program helps you grow your savings by teaching you to spend your money wisely. Adjustable goal tracking, availability of an excellent support team, and the following features justify YNAB’s position on this list.

Key features of YNAB

- It boasts a lot of educational material to improve your understanding of personal finance

- You can share your YNAB account with up to six people

Click here for more information

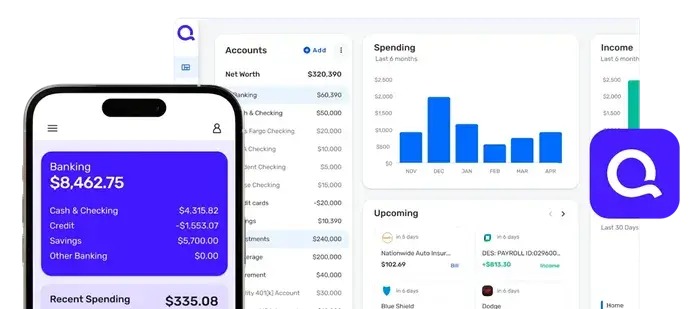

2. Simplifi

Next, we have Simplifi to help you take control of your finances. You can use this software to save more money by always keeping track of what you have left to spend or save, getting detailed insights with real-time alerts and reports, and the following delightful features.

Key features of Simplifi

- It has a user-friendly interface for seamless budgeting and finance management

- Simplifi helps you with a customized spending plan based on your expenses, income, and savings goals

- It timely alerts you about unexpected or unusual transactions, upcoming bills, and subscriptions

- This software lets you download and categorize your transactions and customize them with flags, tags, and more

Click here for more information

Also know: Ways Technology Can Improve Your Finances

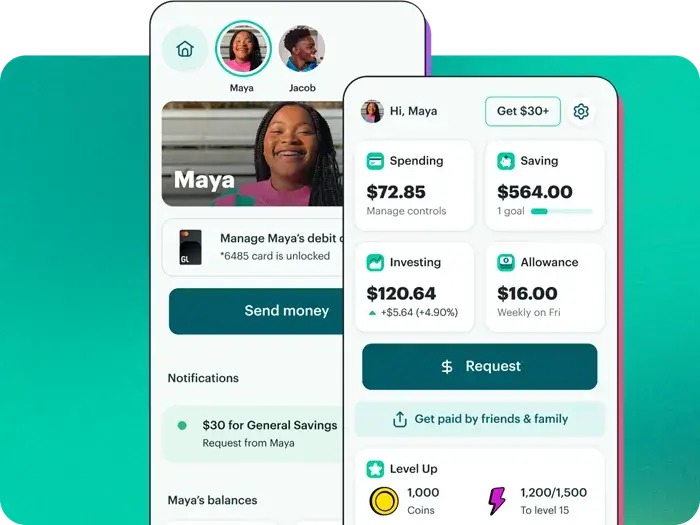

3. Greenlight

Here comes Greenlight, the all-in-one application for money and safety. If you are looking for the best money-management software for your kids, you won’t go wrong with Greenlight. This software helps your kids (under your supervision) understand how to save, spend wisely, lend appropriately, and invest through a family debit card. Moreover, below are a few fascinating features of this software.

Key features of Greenlight

- In addition to finance management, Greenlight offers safety features, such as family location sharing, crash detection with 911 dispatch, SOS alerts, and driving reports with real-time alerts

- It offers round-the-clock customer support

- You can set spending limits and keep track of transactions

- It allows the automatic blocking of certain purchases

Click here for more information

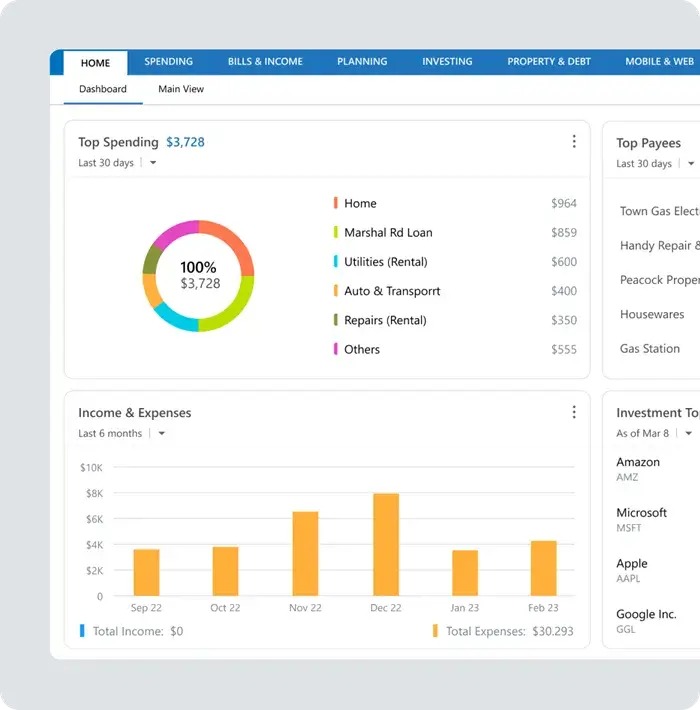

4. Quicken Classic

Quicken Classic is a popular money management software among power users. This application lets you track your expenses and income effortlessly, has a connected companion app to track your financial details even if your computer is not with you, and offers the following features.

Key features of Quicken Classic

- It lets you connect all your financial accounts and boasts automatic syncing with more than 14000 financial institutions

- You can edit and filter your financial reports the way you want

- It offers detailed tax schedules, P&L, cash flow, and other reports

Click here for more information

5. NerdWallet

Another app we recommend if you are looking for a totally free personal finance software is NerdWallet. It offers a wide array of financial information, tools, and deep insights to help you make informed decisions. Moreover, despite being a no-cost application, it does not hamper your experience with intrusive advertisements and offers the following delightful features.

Key features of NerdWallet

- You can import all your financial transactions from various credit cards and banks to easily monitor your income and expenses

- It lets you check your credit score for free to know your creditworthiness

Click here for more information

Also know: Best Cryptocurrency Wallets

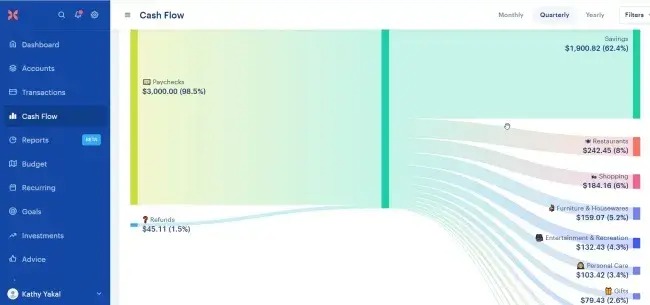

6. Monarch

If you are a self-employed person searching for clean and user-friendly budget software, you can try Monarch. It helps users with highly flexible management of transactions, thorough setup tools, and the following remarkable features.

Key features of Monarch

- It uses AI to find how you can connect each of your accounts in the best way possible

- You can attach transactions to your goals or assign them to a collaborator for review

- Budgeting your money is easy with Monarch, as it lets you create budgets by the assigned groups or categories. Additionally, you can modify the default budget structure and remove specific categories from your budget.

- There is a cash flow feature with many customizable charts and lists viewable by category, group, or merchant

Click here for more information

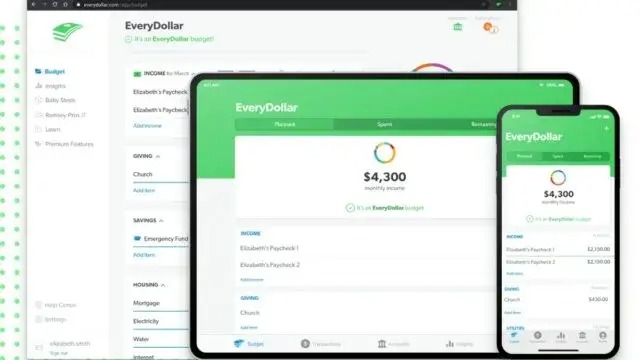

7. EveryDollar

EveryDollar is an excellent personal budgeting software if you are struggling to manage your debt. You can use this zero-based budgeting application to keep track of your money effectively and effortlessly. It offers many categories to customize your budget, helps you plan spending based on your paydays, and offers these exciting features.

Key features of EveryDollar

- It boasts a highly user-friendly interface

- You can view your budget on multiple devices

- It lets you share your household budget with other

- The paid version of this software unlocks many useful features, such as bank account syncing, automatic transactions, and personalized expense-tracking recommendations

Click here for more information

Concluding the Best Personal Budgeting Software

This article acquainted you with the best software for personal finance to help you track and manage your finances well. We hope you found this post helpful in your goal of better money management. However, you can write us a comment if any doubt or question lingers on your mind. We will do whatever we can to address your concern.